If you go out onto the web and starting Googling “FICO” you’ll find a lot of time and energy devoted to explaining how FICO scores are determined. You’d think that with all of this information available, it would be straightforward to determine the effect of various actions on your score. But you would be wrong.

Yesterday I advocated signing up for a new credit card and it reminded me that I recently received this:

Pretty Mir,

I have a question about credit cards. I have 3 credit cards. 1 Discover, and 2 Visas, and I don’t really need both Visas. I’ve heard you (and others) say that opening new credit card accounts can lower your credit score, but can it help improve my credit score if I close extraneous accounts?

Thanks,

Sheryl

The answer is: Ummm, maybe.

The thing about credit scores is that they’re complicated. For a good overview that will, in all likelihood, just confuse you more, have a look at this.

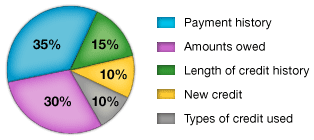

Click on this graphic for the full breakdown on the myFICO site.

Now, as you can see, lots of factors go into your score. There’s no one-to-one relationship; I can’t tell you that “If you do X, your score will drop by 5 points.” I can tell you that certain events are likely to affect your FICO in various ways. For example, I can tell you that late payments will make your score go down.

The problem with predicting how credit cards will impact your FICO score is that there are many factors involved which are contradictory. Having no open credit lines means your score will be low; having too much available credit can also lower your score. Having debt equal to less than 30% of your total available credit will raise your score; having significant debt but also having the ability to borrow enough money to put yourself further into debt can lower your score. Do you see where I’m going with this?

For some general tips on improving your score, go here. But to specifically answer Sheryl’s question, I thought Experian summed it up best:

Any change to the credit report could affect the individual’s scores. Simply closing two accounts not only lowers the number of open installment accounts (which generally will improve your score) but it also lowers the total number of all open accounts (which generally lowers your score). Furthermore, such an action will affect the average age of all accounts that could either raise or lower your score. As you can see, one seemingly simple change actually affects a large number of items on the credit report. Therefore, it is impossible to provide a completely accurate assessment of how one specific action will affect a person’s credit score.

So, bottom line? Closing accounts you don’t use can be a good idea if 1) you already have an excellent credit score, 2) your remaining accounts have a long history and 3) you still have enough available credit that your ratio of debt to potential credit limit is good. If your FICO score isn’t already stellar, just let those accounts sit. They’ll probably help raise your score in the long run.

I know, it’s clear as mud. I hope that helps a little, Sheryl!

Thanks Mir, it sounds like overall I may be better off to keep my account open.

For people looking for a wealth of credit conscious consumers, there is a great resource at http://www.cardratings.com. Their forum goes very in depth to the most personal of issues regarding good credit management and how to get yourself out of a hole. I have found the information there invaluable.